# Create dummy variables for the 'sex' variable

data = pd.get_dummies(data, columns=['sex'], dtype=int)3 Violations of the CLM Assumptions

In Ordinary Least Squares (OLS) regression, the Classical Linear Model (CLM) assumptions ensure that the estimates are BLUE (Best Linear Unbiased Estimators). However, these assumptions are often violated, understanding and addressing these violations is crucial for ensuring that regression models provide valid and reliable conclusions. This section explores violations of three assumptions:

We will study how to detect these issues using diagnostic tests and to apply corrective methods.

3.1 No perfect collinearity

Assumption 3 states that in the sample (and therefore in the population), none of the independent variables is constant, and none of the independent variables in the regression model is an exact linear combination of other independent variables.

If such relationship exists, the model suffers from perfect collinearity, and OLS cannot compute estimates for the regression coefficients. Statistical softwares will either drop a collinear variable automatically or return an error message indicating “singular matrix” or “perfect multicollinearity detected.”

Cases when it fails:

– The model includes the same explanatory variable measured in different units

– The sample size is small relative to the number of parameters being estimated

– An independent variable is an exact linear function of two o more independent variables

The dummy variable trap

Consider the regression:

\[ y = \beta_0 + \beta_1x_1 +\beta_2x_2 +\cdots+\beta_Jx_J+u \]

where all \(J\) explanatory variables are binary. If each observation falls into one and only one category:

\[ x_{1,i} + x_{2,i} +\cdots+x_{J,i} = 1 \] The regression will fail because of perfect multicollinearity.

To the multiple linear regression model estimated earlier add dummy variables for the variable \(sex\). Since there are two different categories we could create two dummmy variables, the model can be written as:

\[ Income_i = \beta_0 +\beta_1 Age_i + \beta_3 Sex\_Male + \beta_3 Sex\_Female +\beta_5 HouseholdSize_i + u_i \]

X = data[['age', 'sex_0','sex_1','householdSize']] # Independent variable

Y = data['income'] # Dependent variable

X = sm.add_constant(X) # Add an intercept term

mrm = sm.OLS(Y, X).fit()

print(mrm.summary()) OLS Regression Results

==============================================================================

Dep. Variable: income R-squared: 0.043

Model: OLS Adj. R-squared: 0.039

Method: Least Squares F-statistic: 11.10

Date: Sun, 02 Mar 2025 Prob (F-statistic): 3.93e-07

Time: 10:02:01 Log-Likelihood: -2446.2

No. Observations: 751 AIC: 4900.

Df Residuals: 747 BIC: 4919.

Df Model: 3

Covariance Type: nonrobust

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

const 7.1130 0.640 11.123 0.000 5.858 8.368

age 0.0559 0.020 2.826 0.005 0.017 0.095

sex_0 3.0210 0.391 7.720 0.000 2.253 3.789

sex_1 4.0920 0.397 10.318 0.000 3.313 4.871

householdSize -0.5633 0.141 -3.992 0.000 -0.840 -0.286

==============================================================================

Omnibus: 155.794 Durbin-Watson: 1.943

Prob(Omnibus): 0.000 Jarque-Bera (JB): 277.910

Skew: 1.245 Prob(JB): 4.49e-61

Kurtosis: 4.636 Cond. No. 4.65e+16

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The smallest eigenvalue is 5.48e-28. This might indicate that there are

strong multicollinearity problems or that the design matrix is singular.The output includes a warning: “The smallest eigenvalue is 5.48e-28. This might indicate that there are strong multicollinearity problems or that the design matrix is singular.” This is because we have incurred in the dummy variable trap.

Solution:

When one variable is an exact linear function of another, remove one of them. In avoiding the dummy variable trap, the coefficients on the included binary variables will represent the incremental effect of being in that category, relative to the base case of the omitted category, holding constant the other regressors.

In the example above, drop the variable ‘sex_0’ :

X = data[['age', 'sex_1','householdSize']] # Independent variable

Y = data['income'] # Dependent variable

X = sm.add_constant(X) # Add an intercept term

mrm = sm.OLS(Y, X).fit()

print(mrm.summary()) OLS Regression Results

==============================================================================

Dep. Variable: income R-squared: 0.043

Model: OLS Adj. R-squared: 0.039

Method: Least Squares F-statistic: 11.10

Date: Sun, 02 Mar 2025 Prob (F-statistic): 3.93e-07

Time: 10:02:01 Log-Likelihood: -2446.2

No. Observations: 751 AIC: 4900.

Df Residuals: 747 BIC: 4919.

Df Model: 3

Covariance Type: nonrobust

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

const 10.1340 0.983 10.306 0.000 8.204 12.064

age 0.0559 0.020 2.826 0.005 0.017 0.095

sex_1 1.0710 0.460 2.327 0.020 0.167 1.975

householdSize -0.5633 0.141 -3.992 0.000 -0.840 -0.286

==============================================================================

Omnibus: 155.794 Durbin-Watson: 1.943

Prob(Omnibus): 0.000 Jarque-Bera (JB): 277.910

Skew: 1.245 Prob(JB): 4.49e-61

Kurtosis: 4.636 Cond. No. 172.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.In python we can drop a reference category when creating the dummy variables as:

data = pd.get_dummies(data, columns=['region'], drop_first=True, dtype=int)but we will still need to manually include each one of the ‘new’ variables in the estimation. Alternatively, we can indicate the variable is categorical directly within the model by using the \(C()\) function inside the formula when estimating the model. For example:

# Reload the original data

data = pd.read_csv("DataENIF.csv")

data = data.dropna()

data.loc[:, 'income'] /= 1000

mean_income = data['income'].mean()

sd_income = data['income'].std()

Lo = mean_income - 3 * sd_income

Up = mean_income + 3 * sd_income

data = data[(data['income'] > Lo) & (data['income'] < Up)]

data = data[data['villageSize'] == 1]import statsmodels.formula.api as smf

mrm = smf.ols("income ~ age + sex + householdSize + C(region)", data=data).fit()

print(mrm.summary()) OLS Regression Results

==============================================================================

Dep. Variable: income R-squared: 0.055

Model: OLS Adj. R-squared: 0.045

Method: Least Squares F-statistic: 5.394

Date: Sun, 02 Mar 2025 Prob (F-statistic): 1.29e-06

Time: 10:02:01 Log-Likelihood: -2441.3

No. Observations: 751 AIC: 4901.

Df Residuals: 742 BIC: 4942.

Df Model: 8

Covariance Type: nonrobust

==================================================================================

coef std err t P>|t| [0.025 0.975]

----------------------------------------------------------------------------------

Intercept 10.1807 1.068 9.530 0.000 8.083 12.278

C(region)[T.2] -0.0345 0.678 -0.051 0.959 -1.365 1.296

C(region)[T.3] 0.0697 0.705 0.099 0.921 -1.315 1.454

C(region)[T.4] 1.6679 0.821 2.031 0.043 0.056 3.280

C(region)[T.5] 0.5050 0.933 0.541 0.588 -1.326 2.336

C(region)[T.6] -1.0525 0.720 -1.462 0.144 -2.466 0.361

age 0.0526 0.020 2.655 0.008 0.014 0.091

sex 1.1346 0.460 2.465 0.014 0.231 2.038

householdSize -0.5656 0.141 -4.020 0.000 -0.842 -0.289

==============================================================================

Omnibus: 157.981 Durbin-Watson: 1.968

Prob(Omnibus): 0.000 Jarque-Bera (JB): 285.065

Skew: 1.254 Prob(JB): 1.26e-62

Kurtosis: 4.678 Cond. No. 231.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.3.1.1 Imperfect collinearity

The assumption allows the independent variables to be correlated; they just cannot be perfectly correlated. Unlike perfect multicollinearity, imperfect multicollinearity does not prevent estimation of the regression. But it means that one or more regression coefficients could be estimated imprecisely. This is because standard errors become large, leading to imprecise coefficient estimates. From the properties of the OLS estimators:

\[ Var(\hat{\beta}_j) = \frac{\sigma^2}{SST_j \ (1-R_j^2)} \]

Where \(SST_j = \sum_{i=1}^n (x_i-\bar{x})^2\) is the total sample variation on \(x\), and \(R^2_j\) is the R-squared from regressing \(x_j\) on all other independent variables (including the intercept).

When \(x_j\) is highly correlated with other variables, the \(R_j^2 \rightarrow 1\) (\(R^2_j=1\) is rule out by the assumption), leading to a large variance and therefore standard errors. High (but not perfect) correlation between two or more independent variables is what is called multicollinearity.

Because multicollinearity violates none of our assumptions, the “problem” of multicollinearity is not really well defined. Everything else being equal, for estimating \(\beta_j\), it is better to have less correlation between \(x_j\) and the other independent variables.

There is no good way to reduce variances of unbiased estimators other than to collect more data. One can drop other independent variables from the model in an effort to reduce multicollinearity, unfortunately, dropping a variable that belongs in the population model can lead to bias.

3.1.2 Detect multicollinearity

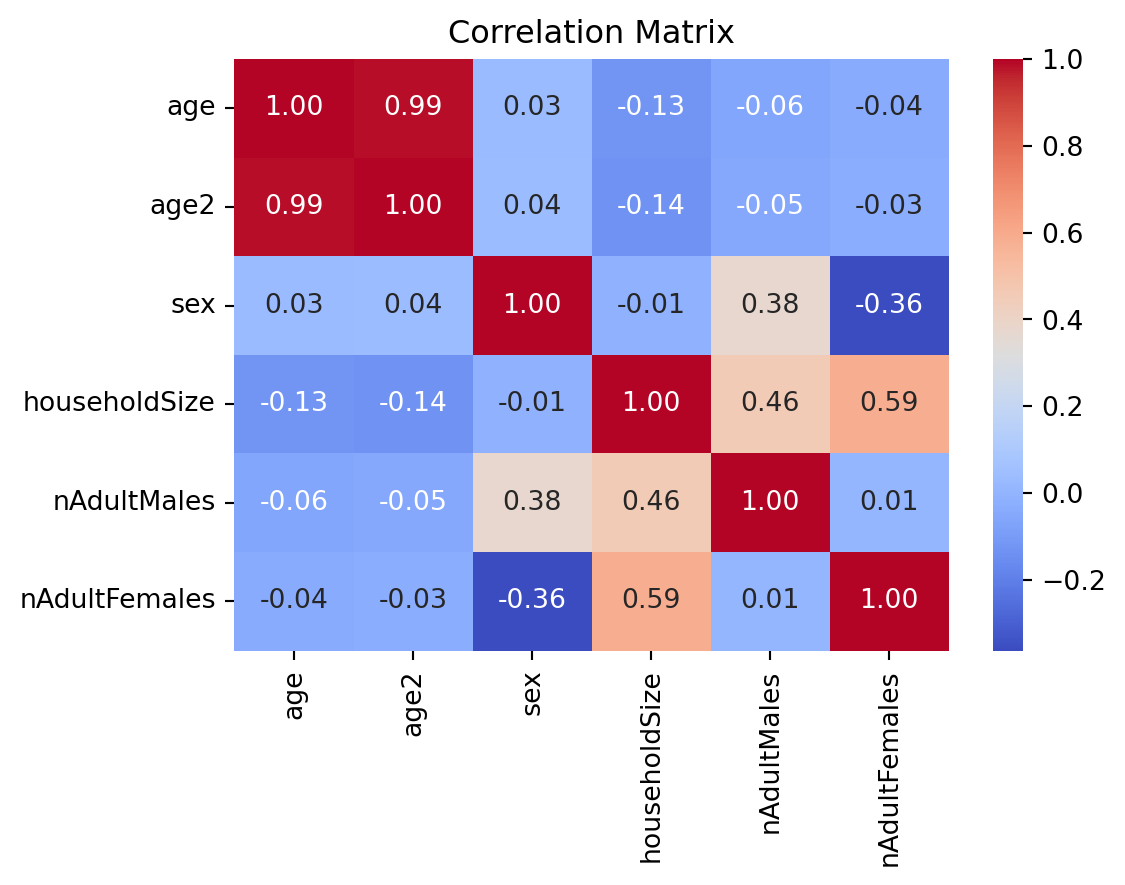

Since collinearity means that one variable is exactly predictable from others, it is usually easy to detect by examining correlation matrix. A correlation coefficient ‘close’ to +1 or -1 between two independent variables is a red flag.

To ilustrate the concept, use the subset of the following variables:

age

age2

sex

householdSize

nAdultMales

nAdultFemales

data['age2'] = data['age'] ** 2

Z = data[['age', 'age2','sex','householdSize','nAdultMales','nAdultFemales']]

# Compute correlation matrix

corr_matrix = Z.corr()

plt.figure(figsize=(6,4))

sns.heatmap(corr_matrix, annot=True, cmap="coolwarm", fmt=".2f")

plt.title("Correlation Matrix")

plt.show()

The variables \(age\) and \(age^2\) are strongly correlated, indicating multicollinearity might be an issue. Although, the correlation is lower, the issue may also be present among variables \(houeholdSize\), \(nAdultMales\), and \(nAdultFemales\).

It is then useful to compute statistics to detect or determine the severity of multicollinearity. The most common statistic is the variance inflation factor (VIF): \[ VIF_i = \frac{1}{1-R^2_j} \]

If we had the choice, we would like \(VIF_j\) to be small (other things equal). An arbitrary cutoff value of the VIF often used to conclude multicollinearity is a “problem” is 10 [if VIFj is above 10 — equivalently, \(R^2_j\) is above 0.9].

from statsmodels.stats.outliers_influence import variance_inflation_factor as vif

# Define the independent variables (excluding the dependent variable)

Z = data[['age', 'age2', 'sex', 'householdSize', 'nAdultMales', 'nAdultFemales']]

# Compute VIF for each variable

vif_data = pd.DataFrame()

vif_data["Variable"] = Z.columns

vif_data["VIF"] = [vif(Z.values, i) for i in range(Z.shape[1])]

# Display VIF results

print(vif_data) Variable VIF

0 age 39.722214

1 age2 22.655474

2 sex 2.769698

3 householdSize 11.785169

4 nAdultMales 5.273431

5 nAdultFemales 6.772311Drop \(houeholdSize\), but keep \(age^2\) beacuse it is needed to capture the nonlinear relationship between age and income.

Z = data[['age', 'age2', 'sex', 'nAdultMales', 'nAdultFemales']]

Y = data['income'] # Dependent variable

Z = sm.add_constant(Z) # Add an intercept term

mrm = sm.OLS(Y, Z).fit()

print(mrm.summary()) OLS Regression Results

==============================================================================

Dep. Variable: income R-squared: 0.069

Model: OLS Adj. R-squared: 0.063

Method: Least Squares F-statistic: 11.10

Date: Sun, 02 Mar 2025 Prob (F-statistic): 2.50e-10

Time: 10:02:01 Log-Likelihood: -2435.5

No. Observations: 751 AIC: 4883.

Df Residuals: 745 BIC: 4911.

Df Model: 5

Covariance Type: nonrobust

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

const 2.9583 2.500 1.183 0.237 -1.949 7.866

age 0.4407 0.121 3.646 0.000 0.203 0.678

age2 -0.0046 0.001 -3.209 0.001 -0.007 -0.002

sex 1.6915 0.534 3.166 0.002 0.642 2.741

nAdultMales -1.4387 0.327 -4.406 0.000 -2.080 -0.798

nAdultFemales -0.4803 0.303 -1.584 0.114 -1.076 0.115

==============================================================================

Omnibus: 156.879 Durbin-Watson: 1.955

Prob(Omnibus): 0.000 Jarque-Bera (JB): 286.602

Skew: 1.236 Prob(JB): 5.82e-63

Kurtosis: 4.746 Cond. No. 2.04e+04

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 2.04e+04. This might indicate that there are

strong multicollinearity or other numerical problems.3.2 Homoskedasticity

Heteroskedasticity occurs when the variance of the error terms (\(u_i\)) is not constant across observations. This violates Assumption 5 of the Ordinary Least Squares (OLS) regression model:

\[ Var(u|x_1,x_2,\dots,x_k) = \sigma^2 \].

In the income regression, heteroskedasticity might occur if, for example, income variability is much higher for high-income individuals than for low-income individuals.

why is it a problem?

OLS estimates are still unbiased [the expected value of the sampling distribution of the estimators is equal the true population parameter value], and consistent [as the sample size increases, the estimates converge to the true population parameter], but the standard errors are incorrect.

Heteroskedasticity invalidates variance formulas for OLS estimators

OLS is no longer the best linear unbiased estimator (BLUE).

The t-tests and F-tests become unreliable, leading to wrong conclusions.

Confidence intervals become misleading, as they might be too narrow or too wide.

3.2.1 Detect Heteroskedasticity

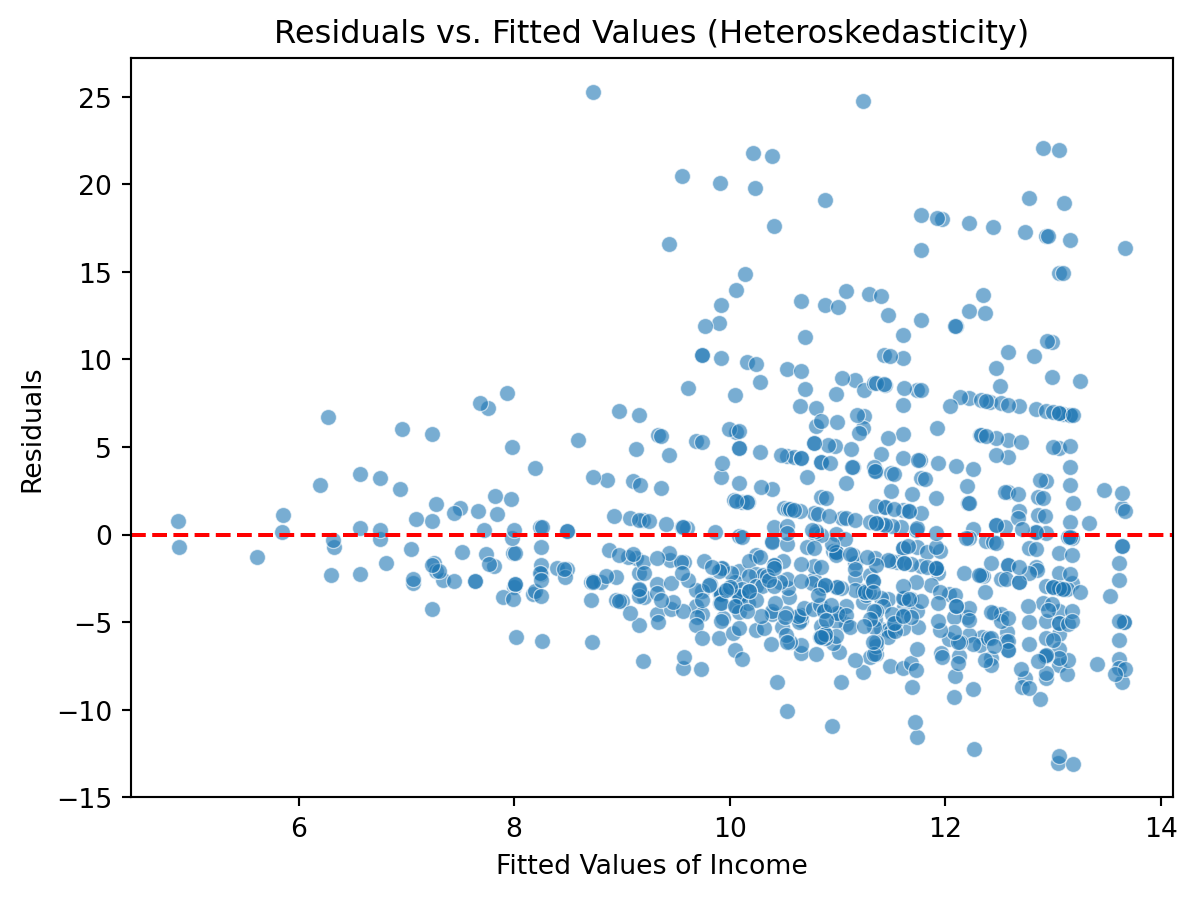

Plot the residuals against the fitted values of the regression. This allows you to visually identify heteroskedasticity if there is an evident pattern in the plot.

If residuals are evenly spread across fitted values \(\rightarrow\) Homoskedasticity.

If widening or narrowing, suggests non-constant variance \(\rightarrow\) Heteroskedasticity.

fitted_values = mrm.fittedvalues # Predicted Y values from the model

residuals = mrm.resid # Model residuals

# Scatter plot of residuals vs fitted values

plt.figure(figsize=(7, 5))

sns.scatterplot(x=fitted_values, y=residuals, alpha=0.6)

plt.axhline(0, color='red', linestyle='dashed') # Reference line at 0

plt.xlabel("Fitted Values of Income")

plt.ylabel("Residuals")

plt.title("Residuals vs. Fitted Values (Heteroskedasticity)")

plt.show()

The plot shows geater variation of the residuals at higher levels of income. Heteroskedasticity appears to be an issue in this example.

We could also use formal tests:

The Breush-Pagan test

Departing from a homoskedastic null hypothesis:

\[ H_0: Var(u|x_1, x_2, \cdots, x_k)= Var(u|\boldsymbol{x})=\sigma^2 \] By definition \(Var(u|\boldsymbol{x}) = E(u^2|\boldsymbol{x})-[E(u|\boldsymbol{x})]^2=E(u^2)=\sigma^2\). That is, under the null hypothesis, the mean of \(u^2\) must not vary with \(x_1, x_2, \cdots, x_k\).

Estimate the model:

\[ \hat{u}^2 = \delta_0 + \delta_1 x_1 + \delta_2 x_2 + \delta_3 x_3 + \cdots + \delta_k x_k + \epsilon \]

and test:

\[ Ho: \delta_1 = \delta_2 = \cdots = \delta_k = 0 \]

A large F-statistic or small p-value is evidence agains the null, therefore heteroskedasticity would be detected.

residuals2 = mrm.resid**2

Z = data[['age', 'age2', 'sex', 'nAdultMales', 'nAdultFemales']]

Z = sm.add_constant(Z) # Add an intercept term

bp = sm.OLS(residuals2, Z).fit()

print(bp.summary()) OLS Regression Results

==============================================================================

Dep. Variable: y R-squared: 0.029

Model: OLS Adj. R-squared: 0.023

Method: Least Squares F-statistic: 4.465

Date: Sun, 02 Mar 2025 Prob (F-statistic): 0.000514

Time: 10:02:01 Log-Likelihood: -4290.3

No. Observations: 751 AIC: 8593.

Df Residuals: 745 BIC: 8620.

Df Model: 5

Covariance Type: nonrobust

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

const 12.4981 29.546 0.423 0.672 -45.506 70.502

age 1.4149 1.429 0.990 0.322 -1.390 4.219

age2 -0.0083 0.017 -0.488 0.626 -0.042 0.025

sex 4.9734 6.315 0.788 0.431 -7.425 17.372

nAdultMales -10.8536 3.859 -2.812 0.005 -18.430 -3.277

nAdultFemales -3.4987 3.584 -0.976 0.329 -10.535 3.538

==============================================================================

Omnibus: 682.775 Durbin-Watson: 1.978

Prob(Omnibus): 0.000 Jarque-Bera (JB): 17147.833

Skew: 4.211 Prob(JB): 0.00

Kurtosis: 24.842 Cond. No. 2.04e+04

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 2.04e+04. This might indicate that there are

strong multicollinearity or other numerical problems.Alternatively:

from statsmodels.stats.diagnostic import het_breuschpagan

bp_test = het_breuschpagan(residuals, Z)

bp_stat, bp_pvalue = bp_test[0], bp_test[1]

print(f"Breusch-Pagan Test Statistic: {bp_stat:.4f}")

print(f"P-value: {bp_pvalue:.4f}")

# Implement the Decision Rule:

alpha = 0.05

if bp_pvalue < alpha:

print("Heteroskedasticity detected (Reject H0)")

else:

print("No statistical evidence of heteroskedasticity (Fail to reject H0)")Breusch-Pagan Test Statistic: 21.8495

P-value: 0.0006

Heteroskedasticity detected (Reject H0)White test

Regress \(u^2\) against all explanatory variables, their squares, and interactions. For \(k=2\):

\[ \hat{u}^2 = \delta_0 + \delta_1x_1 + \delta_2x_2 + \delta_{3}x_1^2 + \delta_{4}x_2^2 + \delta_5x_1x_2 +\epsilon \] The null hypothesis: \[ H_0: \delta_1 = \delta_2 = \cdots = \delta_5=0 \]

The White test detects more general deviations from heteroskedasticity than the Breush-Pagan test. A disadvantage is it includes a large number of estimated parameters.

Alternative form of the White test for heteroskedasticity:

\[ u^2 = \delta_0 + \delta_1\hat{y} + \delta_2\hat{y}^2+\epsilon \] Indirectly tests the dependence of the squared residuals on the explanatory variables, their squares, and interactions (contained in \(\hat{y}\) and \(\hat{y}^2\)).

from statsmodels.stats.diagnostic import het_white

white_test = het_white(residuals, Z)

white_stat, white_pvalue = white_test[0], white_test[1]

print(f"White Test Statistic: {white_stat:.4f}")

print(f"P-value: {white_pvalue:.4f}")

# Implement the Decision Rule

alpha = 0.05

if white_pvalue < alpha:

print("Heteroskedasticity detected (Reject H0)")

else:

print("No statistical evidence of heteroskedasticity (Fail to reject H0)")White Test Statistic: 39.6505

P-value: 0.0023

Heteroskedasticity detected (Reject H0)3.2.2 Correct Heteroskedasticity

Remember: If heteroskedasticity is detected, OLS estimates remain unbiased, but standard errors are wrong. We can fix this by using robust standard errors. Several methods (HC0, HC1, HC2, HC3) that differ in how they adjusts for heteroskedasticity and small-sample bias available:

# HC0 (large sample size)

mrm_robust0 = mrm.get_robustcov_results(cov_type="HC0")

print(mrm_robust0.summary()) OLS Regression Results

==============================================================================

Dep. Variable: income R-squared: 0.069

Model: OLS Adj. R-squared: 0.063

Method: Least Squares F-statistic: 14.95

Date: Sun, 02 Mar 2025 Prob (F-statistic): 5.31e-14

Time: 10:02:01 Log-Likelihood: -2435.5

No. Observations: 751 AIC: 4883.

Df Residuals: 745 BIC: 4911.

Df Model: 5

Covariance Type: HC0

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

const 2.9583 2.578 1.147 0.252 -2.103 8.019

age 0.4407 0.135 3.276 0.001 0.177 0.705

age2 -0.0046 0.002 -2.695 0.007 -0.008 -0.001

sex 1.6915 0.519 3.257 0.001 0.672 2.711

nAdultMales -1.4387 0.299 -4.816 0.000 -2.025 -0.852

nAdultFemales -0.4803 0.265 -1.816 0.070 -1.000 0.039

==============================================================================

Omnibus: 156.879 Durbin-Watson: 1.955

Prob(Omnibus): 0.000 Jarque-Bera (JB): 286.602

Skew: 1.236 Prob(JB): 5.82e-63

Kurtosis: 4.746 Cond. No. 2.04e+04

==============================================================================

Notes:

[1] Standard Errors are heteroscedasticity robust (HC0)

[2] The condition number is large, 2.04e+04. This might indicate that there are

strong multicollinearity or other numerical problems.Other options:

# HC1 (Stata default, recommended for small/moderate samples)

mrm_robust1 = mrm.get_robustcov_results(cov_type="HC1")

# print(mrm_robust.summary())

# HC2 (Adjusts for leverage points)

mrm_robust2 = mrm.get_robustcov_results(cov_type="HC2")

# print(mrm_robust_HC2.summary())

# HC3 (More conservative, useful for small samples)

mrm_robust3 = mrm.get_robustcov_results(cov_type="HC3")

# print(mrm_robust_HC3.summary())3.3 Serial correlation

Autocorrelation, also known as serial correlation, occurs when the error terms (\(u_i\)) are correlated across observations. It emerges when observations are spatially or logically related (e.g., geographic clustering), if the residuals from one observation are correlated with another, this suggests systematic patterns that OLS fails to capture. This violates assumption 6, that the error terms should be independently distributed:

\[ E(u_i,u_j) = 0, \ \ \ for \ \ i \ne j \]

why is it a problem?

Even though OLS estimates remain unbiased:

Standard Errors are underestimated, making t-tests and confidence intervals invalid.

t-statistics and F-statistics become inflated, leading to a higher probability of Type I errors (rejecting a true null hypothesis).

OLS is no longer the Best Linear Unbiased Estimator (BLUE)

3.3.1 Detect Autocorrelation

Autocorrelation is a serious issue in time series data where observations are sequential (e.g., stock prices, GDP growth, inflation, interest rates) as the residuals from one period maybe corelated with the next period. If the data is a time series one simple way to check for autocorrelation is to plot residuals over time. If the residuals appear randomly scattered around zero, there is evidence of no autocorrelation. But if residuals form a clear pattern (e.g., trending up/down) or alternate frequently (high-low-high-low), there is evidence of positive or negative autocorrelation, respectively.

Durbin-Watson Test

The Durbin-Watson (DW) test is primarily used for time series data, where observations are sequentially ordered over time. It detects first-order autocorrelation in the residuals of a regression model, meaning that the error at time \(t\) depends on the error at time \(t−1\).

The null hypothesis \(H_0\) states that there is no autocorrelation in the residuals:

\[ H_0: \rho = 0 \] The Durbin-Watson statistic, \(DW\), is computed as: \[ DW = \frac{\sum_{t=2}^n(u_t-u_{t-1})^2}{\sum_{t=1}^n u_t^2} \]

It measures the sum of squared differences between adjacent residuals relative to the total sum of squared residuals.

\(DW \approx 0:\) Strong positive autocorrelation.

\(DW \approx 4:\) Strong negative autocorrelation.

\(DW \approx 2:\) No autocorrelation.

from statsmodels.stats.stattools import durbin_watson

# Compute Durbin-Watson statistic

dw_stat = durbin_watson(residuals)

print(f"Durbin-Watson Statistic: {dw_stat:.4f}")Durbin-Watson Statistic: 1.9551A disadvantage of the DW test is that it only detecs autocorrelation of first-order. For higher-order Autocorrelation use the Breusch-Godfrey Test.

Breusch-Godfrey Test

The Breusch-Godfrey test can detect autocorrelation of any order (\(p\)), meaning it checks if the residual at time \(t\) is related to residuals from previous periods \((t−1,t−2,...,t−p)\).

The test examines whether the residuals exhibit serial correlation:

\[ H_0: \rho_1 = \rho_2 = \cdots = \rho_p \]

The null hypothesis states that residuals are not autocorrelated, that is, no serial correlation (errors are independent).

from statsmodels.stats.diagnostic import acorr_breusch_godfrey

# Specify the bumber of lags

bg_test = acorr_breusch_godfrey(mrm, nlags=2)

bg_stat, bg_pvalue = bg_test[0], bg_test[1]

print(f"Breusch-Godfrey Test Statistic: {bg_stat:.4f}")

print(f"P-value: {bg_pvalue:.4f}")

# Implement the decision Rule

alpha = 0.05

if bg_pvalue < alpha:

print("Autocorrelation detected (Reject H0)")

else:

print("No evidence of autocorrelation (Fail to reject H0)")Breusch-Godfrey Test Statistic: 0.5242

P-value: 0.7694

No evidence of autocorrelation (Fail to reject H0)The tests indicates that the residuals in our model are not serially correlated.

3.3.2 Correct autocorrelation

If autocorrelation is detected, we need to adjust our regression model to obtain valid inference. Although not necessary in our model, some solutions can be implemented in python as follows:

Newey-West Robust Standard Errors

Re-estimate model with Newey-West robust standard errors to correct t-tests and confidence intervals for autocorrelation. It allows for autocorrelation up to lag 2.

mrm_newey = mrm.get_robustcov_results(cov_type="HAC", maxlags=2)

# Display results

print(mrm_newey.summary()) OLS Regression Results

==============================================================================

Dep. Variable: income R-squared: 0.069

Model: OLS Adj. R-squared: 0.063

Method: Least Squares F-statistic: 15.49

Date: Sun, 02 Mar 2025 Prob (F-statistic): 1.63e-14

Time: 10:02:01 Log-Likelihood: -2435.5

No. Observations: 751 AIC: 4883.

Df Residuals: 745 BIC: 4911.

Df Model: 5

Covariance Type: HAC

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

const 2.9583 2.516 1.176 0.240 -1.981 7.898

age 0.4407 0.133 3.301 0.001 0.179 0.703

age2 -0.0046 0.002 -2.684 0.007 -0.008 -0.001

sex 1.6915 0.502 3.368 0.001 0.706 2.677

nAdultMales -1.4387 0.303 -4.753 0.000 -2.033 -0.844

nAdultFemales -0.4803 0.246 -1.956 0.051 -0.962 0.002

==============================================================================

Omnibus: 156.879 Durbin-Watson: 1.955

Prob(Omnibus): 0.000 Jarque-Bera (JB): 286.602

Skew: 1.236 Prob(JB): 5.82e-63

Kurtosis: 4.746 Cond. No. 2.04e+04

==============================================================================

Notes:

[1] Standard Errors are heteroscedasticity and autocorrelation robust (HAC) using 2 lags and without small sample correction

[2] The condition number is large, 2.04e+04. This might indicate that there are

strong multicollinearity or other numerical problems.The HAC (Heteroskedasticity and Autocorrelation Consistent) covariance estimator corrects standard errors to account for both issues.

Generalized Least Squares (GLS)

GLS adjusts for autocorrelation by modeling error terms as an AR(1) process, that is,

\[ u_t = \rho u_{t-1} + \epsilon \]

# Fit GLS model (assumes AR(1) error structure)

mrm_gls = sm.GLSAR(Y, Z, rho=1).iterative_fit()

# Display results

print(mrm_gls.summary()) GLSAR Regression Results

==============================================================================

Dep. Variable: income R-squared: 0.069

Model: GLSAR Adj. R-squared: 0.063

Method: Least Squares F-statistic: 11.01

Date: Sun, 02 Mar 2025 Prob (F-statistic): 3.03e-10

Time: 10:02:01 Log-Likelihood: -2432.5

No. Observations: 750 AIC: 4877.

Df Residuals: 744 BIC: 4905.

Df Model: 5

Covariance Type: nonrobust

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

const 3.1093 2.503 1.242 0.215 -1.804 8.023

age 0.4335 0.121 3.583 0.000 0.196 0.671

age2 -0.0046 0.001 -3.149 0.002 -0.007 -0.002

sex 1.6946 0.535 3.165 0.002 0.644 2.746

nAdultMales -1.4362 0.327 -4.393 0.000 -2.078 -0.794

nAdultFemales -0.4940 0.303 -1.630 0.104 -1.089 0.101

==============================================================================

Omnibus: 158.283 Durbin-Watson: 1.994

Prob(Omnibus): 0.000 Jarque-Bera (JB): 291.453

Skew: 1.243 Prob(JB): 5.15e-64

Kurtosis: 4.773 Cond. No. 2.01e+04

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 2.01e+04. This might indicate that there are

strong multicollinearity or other numerical problems.Important:

When the nature of the data is time-dependent, autocorrelation might be strong and persistent. In such cases using proper econometric time series techniques would be more appropriate than simply trying to correct the issue within the OLS framework.